Medicare is sustainable,

for-profit care is not.

BRIEFING NOTE

Canadian Health Coalition

www.medicare.ca

Ottawa, May 14, 2004

ISSUE

Canadians are being told that Medicare is not

sustainable and that spending must be shifted from public to private budgets and delivery.

BACKGROUND

Prime

Minister Martin has called for a First Ministers’ Conference (FMC) this summer to

adopt a 10-year Medicare ‘sustainability’ plan.

The premise of the plan appears to be that our health care system is

unaffordable and that the provinces need to make major changes. Claims are also made that

cost increases are crowding out other government priorities. These claims are

unsustainable, based on the data.

According to a Finance Department

study, health care will remain affordable over the next 40 years. Share of total health

care expenses for Canada will likely remain less than 10 per cent of the Canadian economy.

Current health care spending is 9.8 per cent of GDP (Jackson

and McDermott, 2004).

Public health care

expenditures are not exceeding public resources. The parts of health care expenditures

that are out of control are those not covered by the Canada

Health Act; especially drugs. Drug costs have tripled as a share of national income in

20 years. Medicare spending (hospitals and physicians) takes up the same share of national

income as 20 years ago.

Claims that Medicare is

financially unsustainable are part of a broader campaign to advance the priorities of tax

cuts, smaller governments and the expansion of investor-owned health care delivery.

This agenda is a perversion

of the core Canadian value of equal access to health care for all, financed on

income-based taxation. The vast majority of Canadians believe safeguarding equal and

timely access to public health care is more important than tax cuts.

In the words of the Romanow

Report: Canadians have been clear that they still

strongly support the core values on which our health care system is premised –

equity, fairness and solidarity…They want and they expect their governments to work

together to ensure that the policies and programs that define medicare remain true to

these values.

CONSIDERATIONS

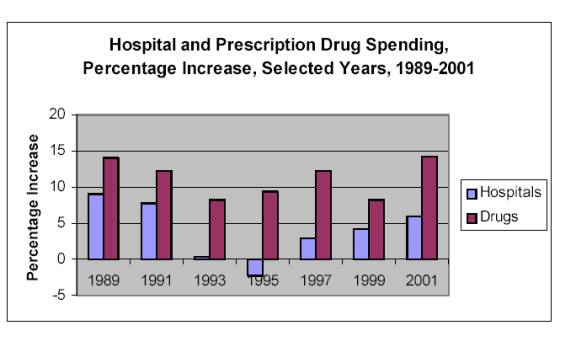

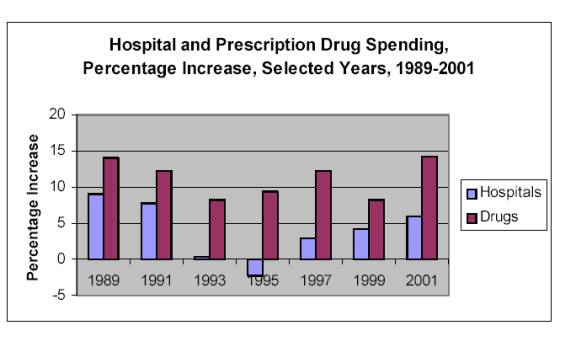

1. Financial pressures are from drug costs, not

Medicare

In 2002, hospital and physician services

accounted for 4.3% of national income, down from 4.5% in 1971. The share of national

income devoted to public health insurance programs has been remarkably stable.

Expenditures on prescription drugs, on the other hand, which are outside of Medicare, have

been growing rapidly, more than tripling their share of national income since 1980. The

drug industry claims that this increase has reduced hospital costs. This claim

“cannot withstand any serious empirical scrutiny” (Evans, 2003).

|

|

|

Universal, comprehensive

coverage is not more expensive than the fragmented mix of public and private insurance

coverage and out-of-pocket payment that existed before Medicare. Consolidation of

expenditures in the hands of a single payer made it possible to control costs and expand

access. If services are not affordable for a society on a universal basis through a single

payer, not-for-profit system, they are not affordable in an American-style system of

for-profit delivery.

Why would those who say the Canadian health-care

system is in a fiscal crisis and headed for collapse focus on the public insurance programs, hospital and physician

expenditures? Why would any rational person, concerned about rising costs, advocate

transferring costs from government budgets back onto patients, either directly or through

increased private insurance contributions? Based on all available evidence, such a shift

would almost certainly lead to more rapid

escalation of health spending.

2.

The real motives: narrow self-interest

The

data shows Medicare is sustainable. So what are the real motives behind the talk of

Medicare’s unsustainability? A powerful elite, pursing a narrow self-interest, wants

access to the best health care money can buy without having to pay the taxes needed to

provide equal access for all Canadians. Some of those elite also stand to benefit

financially from selling private health care services.

Universal, tax-financed health care requires

higher-income people to contribute more to support the system, without offering them

preferred access or a higher standard of service. Private financing reduces the burden on

the wealthy because they are healthier. Private payments limit access by people with lower

incomes and thereby open better access for those willing and able to pay.

Moving away from fully

tax-financed public insurance would let the wealthy pay

less (in charges, private premiums and taxes) and get more (in volume, quality, and/or

timeliness). Those with lower incomes would pay more and get less. This conflict in

economic interest is real, unavoidable, and present in all societies. This explains why

the “public/private” debate never goes away. (Evans, 2003)

Policy proposals for structural “reform” are

in reality, attempts to redistribute burdens and benefits. Private health care is not only

a perversion of Canadian Medicare values. It is also less efficient, more expensive and

diverts care from those with greatest needs to those with greatest resources. Private

health care is fraught with fraud and higher death rates. But a small elite still come out

ahead.

Claims that Canada’s

Medicare is economically or fiscally unsustainable are part of a broader campaign to

advance the priorities of the few at the expense of the many.

3. For-profit health care

is not sustainable

Sustainability is also a code word for

"privatization" and "for-profit care."

Increased privatization depends upon an argument that public healthcare is

unsustainable. Once we accept that premise,

then it is a simple matter to turn health services over to for-profit corporations. Recent

evidence has shown that private for-profit ownership of hospitals, in comparison with

private not-for-profit ownership, results in a higher risk of death for patients (Deveraux, 2002).

Federal, provincial and

local governments contribute approximately $85 billion in taxpayers’ money to our

health care system. Twenty billion of that is

federal money transferred to the provinces under the new Canada Health Transfer. This is money that profit - making corporations

would dearly like to get their hands on.

Privatization of existing

publicly delivered health services are their preference.

Private surgical clinics and hospitals providing joint replacement or

eye surgeries are prime targets. So are diagnostic clinics for CT, MRI and PET scans, and

long term care and home care services. Corporations

prefer single payer arrangements because they constitute the contracting out of public

services with a guaranteed government revenue stream to the for-profit service provider. In fact, in some cases such as long term

care and home care they would even prefer increased public spending for private for-profit

care – so much for their sustainability concern.

Much has been made of

"eliminating waiting lists" and "guaranteed waiting times." It is

essential that we make reforms to Medicare so that accessibility to health care services

is timely. However, the reform presented by

corporate health care providers is simply to contract services out to investor owned

health care providers, padding their pockets with public money, doing little to reduce

waiting times, and doing nothing to improve efficiencies and sustainability. And in the process two – tier health care

will be established where those who can afford to pay privately and jump the queue, will.

The real message is that private,

for-profit health care is not sustainable. Waiting

lists are reduced only for those who can afford to pay. Studies have shown that public

waiting lists for cataract surgeries are longer when there is a parallel for-profit system

in operation. According to Alberta Health (http://www.health.gov.ab.ca/system/funding/performance/Cataract.pdf)

average wait times for cataract eye surgery in Calgary, where 100% of surgeries are done

privately, almost three times longer than Edmonton, which is 80% public. Costs will not

decrease. For-profit corporations will pursue

more public money and will sacrifice care for profits.

Public private partnerships (P3s), often pitched as the

panacea for sustainability problems for hospitals, actually result in fewer hospital beds

in the community, reductions in health care personnel and a decrease in the quality of

care. P3s do not contribute to

sustainability for health care as they cost more than public infrastructure financed with

public dollars. Public expenditures on health care are not diminished. See Auerbach et

al. “Funding Hospital Infrastructure: Why P3s Don’t Work and What

Will”. http://www.policyalternatives.ca/publications/p3-hospitals-summary.html

4. Federal health care

spending at historic lows

Federal

support has languished for the national program Canadians value most. Under Finance

Minister and now Prime Minister, Paul Martin, federal spending on all programs as a

percentage of the gross domestic product (GDP) has fallen to 1949 levels. Martin has

ushered in a ‘Permanent Revolution in Government’ (Yalnizyan, 2004a) of smaller government and bigger

markets.

Between 1995/96 and 1997/98, Finance Minister Martin

cut federal cash transfers by $5 billion, or nearly 20%, leaving a substantial hole in

provincial and territorial budgets. The federal strategy was very successful in shifting

the deficit onto the backs of the provinces and territories. At the same time, the

Government of Canada has been recording major surpluses since 1997/98 and seems likely to

do so for the indefinite future. Rather than restoring the cash grants to their pre-Canada

Health & Social Transfer rate, Finance Minister Martin chose to cut federal income tax

rates.

Chart 2: Federal real per capita health support is at

historic lows

Source:

Provincial data CIHI, NHEX Table B4.7, 2001; federal data calculated from Finance

Department data), updated to reflect the September 2000 agreement, in Yalnizyan, 2004b.

5. Public health care,

other program spending, and tax cuts

From 1995/96 to 2001/02,

health spending by all provincial and territorial governments in Canada rose from 34.8% of

total program spending to 41.1%. This trend is used to make the claim that escalating

health care costs in the public sector are increasingly crowding out other important forms

of public expenditure – clearly an unsustainable situation. Allegedly, this problem

can be addressed only by transferring costs from public to private budgets.

Both the total spending by

provincial governments and spending on Medicare programs alone, took up roughly the same

share in 2001/02 as in 1995/95, a share little different from twenty years earlier. So why

are we now being told that health care spending is “crowding out” education and

other social programs?

Chart 3 Provincial

Government Expenditure as percent 0f GDP - 1980/81 to 2002/03

Source: Evans, December 2003 (data updated in 2004).

In light of this reality, it

follows that provinces must have been cutting back on their non-health spending, and

indeed they were. The myth of health care “crowding out” other program spending

implies that health spending was rising as a share of provincial revenues as well as of

program expenditures. This is not so. Medicare spending now takes up roughly the same

share of provincial revenue as it did twenty years ago.

The

truth is that right-wing governments in several large provinces chose tax cuts and deeper

cuts to non-health programs. Further cuts to

health spending were more politically difficult. In this sense, one could say health care

“crowded out” other programs. But

it would be false to claim that an unsustainably expensive public health care system has

been the source of the pressure on other programs. (Evans, 2003)

These choices were not due

to fiscal necessity from poor economic performance. Rather, it was a political decision to

take advantage of an improved economy to cut taxes rather than maintain spending on public

programs.

6. Are

human rights and compassion sustainable? Values in conflict

What

is it that needs to be sustained? Canadians have made it clear that they care about equal

access to health care for all Canadians. Canadians rated equal access to health care for

all as the area of greatest concern in health care in polling from 1995 to 2003.

The value of equal access is not shared by everyone in society. For example, Michael Kirby, a director of

Extendicare Inc., a for-profit nursing home chain, authored a Senate report which asks:

“Is it fair to deny people who can afford to buy health services the right to buy

those services?” (Senate Health Committee Report, Volume 4, p. xv). Senator Kirby

feels so strongly about his libertarian values that he intervened with nine other senators

in a Supreme Court case to argue that Canada’s public health insurance and hospital

legislation should be struck down as unconstitutional. http://www.healthcoalition.ca/chaoulli.html

Only

18 per cent of Canadians would allow for privatized health care where money can buy you

better care or quicker access.

The

debate over the sustainability of Medicare is primarily about ethics and values, not

economics and finances. Some politicians today want us to believe there isn’t enough

public money to provide health care for everyone, but somehow, privatizing health care

services and driving up costs`, will make it more affordable for the public. Beware of

this deception. There is only one taxpayer.

In

the words of the recent Finance Department study: “Given the wide range of spending

options that are fiscally feasible, discussions of sustainability ultimately become a

question of public choice.” (Jackson and

McDermott, 2004).

‘Medicare

is as sustainable as we want it to be’. (Romanow).

Citizens

in a democracy are the ones to determine what share of our collective wealth ought to be

spent on Medicare.

RECOMMENDATIONS

To ensure that Medicare is

sustainable, the Canadian Health Coalition recommends the following:

1.

Restore federal cash transfers to at least

25% of total health care costs - which includes the full continuum of care - from

prevention and promotion through to home and community care, acute care, palliative and

long-term term care. Establish a transfer escalator to ensure federal share is maintained

over time. Attach strings and conditions so new money goes to public health care not

provincial tax cuts.

2. Direct

public funds to care not profits. Tax dollars are

for giving care not taking profits. To prevent commercial waste of tax dollars, loss of

public accountability and threats to patient safety, a moratorium must be placed on any

initiatives to privatize the delivery of health care services and a prohibition on all

public private ‘partnerships’ in health care. Health care belongs in the public

sector not in the hands of private investors.

3. Use the new

money to buy change. Establish national standards

for home and long-term care, including not-for-profit delivery. Coordinate a national

pharmaceutical strategy. To ensure safety, access and affordability, the strategy must

include cost controls, a public drug information system, improved access to generic

alternatives, enforcing the ban on

direct-to-consumer drug advertising, and effective monitoring of adverse drug reactions.

4. Reduce waiting times with

stable funding to ensure public capacity for the full continuum of health services

including diagnostics, home and long-term care, 24/7 access to care, human resource

planning and publicly financed capital investments. Waiting times are about planning for

care. This requires stable funding and a plan. Wait time guarantees are counter-productive

and result in perverse incentives that encourage two-tier for-profit care.

5. Address the social determinants of health, including affordable housing, for all Canadians and especially

for First Nations, Inuit, and Métis peoples. Improve access to all levels of health care

services and recruit new Aboriginal health care providers.

6. Enforce the Canada Health

Act’s five criteria (public administration,

comprehensiveness, universality, portability, accessibility) and two conditions

prohibiting extra-billing and user fees. Correct the deficiencies in monitoring, reporting

and enforcing compliance.

7. Health Promotion and disease prevention requires that the federal government uphold the duty of care in

the Food & Drugs Act. Terminate proposal for new Canada Health Protection Act.

Preventable damages from adverse drug reactions, food-borne pathogens, and hazardous

medical devices - threaten the health of Canadians and the sustainability of Canada’s

health care system.

8.

Protect the health care system from trade

agreements by negotiating a general

exclusion in trade agreements for health services and health insurance.

REFERENCES

Lewis Auerbach, Arthur

Donner, Douglas D. Peters, Monica Townson, and Armine Yalnizyan, Funding Hospital Infrastructure: Why P3s Don't Work,

and What Will, Canadian Centre for Policy Alternatives, November 2003. http://www.policyalternatives.ca/publications/p3-hospitals-summary.html

P.J. Deveraux,

“A Systematic review and meta-analysis of studies comparing mortality rates of

private for-profit and private not-for-profit hospitals”, Canadian Medical Association Journal, May 28,

2002 http://www.healthcoalition.ca/CMAJ.pdf

Robert

G. Evans, Political Wolves and Economic Sheep: The

Sustainability of Public Health Insurance in Canada, Centre for Health Services and

Policy Research, UBC, December 2003 http://www.chspr.ubc.ca//chspr/pdf/chspr03-16W.pdf

Harriet Jackson and Alison

McDermott, Health Care Spending: Prospect and

Retrospect, Analytical Note, Economic and Fiscal Policy Branch, Department of Finance,

January 2004. www.healthcoalition.ca/finance-note.pdf

Armine Yalnizyan, Paul Martin’s Permanent Revolution,

Alternative Federal Budget 2004 Technical Papers #3, Canadian Centre for Policy

Alternatives, 2004. http://www.policyalternatives.ca/

Armine Yalnizyan, “The

Health Care Budget: Did it resolve the ‘Crisis’?”, in Charles Beach and

Thomas Wilson, eds., The 2003 Federal Budget:

Conflicting Tensions, Kingston: John Deutsch Institute, 2004b, pp. 231-262.

Public money is for patients, not profits.

www.medicare.ca

| Finance Says Medicare is Sustainable Globe

and Mail, Apr. 15, 2004 |

By HEATHER SCOFFIELD |

|

|

|

Ottawa — Health care will remain affordable over the next 40

years as long as the economy and private spending continue to grow at a moderate pace,

says a new internal Finance Department study obtained by The Globe and Mail.

The analysis from the department's fiscal-policy division was

written in January and discounts predominant theories that rising health-care costs will

bankrupt federal and provincial governments unless serious reforms are undertaken.

The study argues that although health-care costs will continue to

rise, historical spending patterns show that governments will have enough money to pay

their share of the bill for decades to come.

The aging population alone will not drive up costs

astronomically, as many fear, said Alison McDermott, who wrote the report with fellow

economist Harriet Jackson.

"As the country gets richer, it will be able to afford more

for health care as well," Ms. McDermott said in an interview yesterday.

"The projections show sizable increases in total health-care

spending as a share of GDP over the next 40 years," says the study, which will be

expanded upon and turned into a public working paper. "However, scenarios believed to

be most plausible appear manageable from a fiscal standpoint."

Their conclusion challenges assumptions that dominate thinking on

health care across the political spectrum. The federal government is seized with the issue

of how to make funding sustainable on a long-term basis, assuming that costs are rising

too quickly for Ottawa and the provinces to carry on.

Last week, Prime Minister Paul Martin approved the hiring of

economist Paul Boothe, director of the University of Alberta's Institute for Public

Economics, as a top-ranking official at the Department of Finance. Mr. Boothe is known for

his radical ideas on health-care funding, and has proposed that patients be forced to pay

for some of their costs, based on income.

Mr. Martin has made it clear that reforming health care is his

priority and that he wants to have a 10-year plan to make sure Canada can pay for publicly

funded health care.

The premise of the plan is that health care in Canada is in

serious trouble and that the provinces need to make major reforms for the federal

government even to contemplate increasing funding.

But the internal Finance Department document could undermine that

premise. The authors say governments' share of total health-care expenses for the country

will likely remain less than 10 per cent of the size of the Canadian economy. Right now,

public and private health care in Canada together amount to 9.8 per cent of gross domestic

product. The study concludes that increasing expenses can be shouldered by both the public

and the private sector.

"The total government sector looks to be quite

sustainable," Ms. McDermott said. |

|

|